child tax credit number

Make sure you have the following information. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

Tax Tip Tool Available To Track Your Advance Child Tax Credit Payments Taxpayer Advocate Service

This child tax credit contact service number 0843 902 1827 is totally unique for addressing the consumer service experts obtainable in the little one tax credits customer care department.

. You can also use Relay UK if you cannot hear or speak on the phone. Department of Revenue Services. The amount you can get depends on how many children youve got and whether youre.

2021 Child Tax Credit payments are made to eligible parents and guardians based on the number of qualifying children they have. The Child Tax Credit provides money to support American families. The Child Tax Credit Update Portal is no longer available.

For example if you call the IRS business phone number you wont get the answer youre looking for as the representatives at the end of the line arent going to have them. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Telephone agents for the following benefits and credits are available.

Employees Withholding Certificate. Choose the location nearest to you and select Make Appointment. Similarly any children using an ITIN instead of a Social Security number cant be taken into account when an otherwise qualified individual claims the credit.

IMPORTANT INFORMATION - the following tax types are now available in myconneCT. Payment amounts for each qualifying child depend on the. Single or head of household or qualifying widow er 75000 or less.

You can claim the Child Tax Credit. 44 2890 538 192. Dial 18001 then 0345 300 3900.

Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. To get started you can call 800-829-1040 to reach the tax agency about an issue youre having with your child tax credit payment. Married filing a joint return.

No you may not claim the child tax credit for a child with an ITIN. Already claiming Child Tax Credit. The child must have an SSN to be a qualifying child eligible for the child tax credit CTC additional.

Making a new claim for Child Tax Credit. You may be able to claim the credit even if you dont normally file a tax return. A childs age determines the amount.

Request for Transcript of Tax Return Form W-4. Request for Taxpayer Identification Number TIN and Certification Form 4506-T. Overview The American Rescue Plans expansion of the Child Tax Credit will reduced child poverty by 1 supplementing the earnings of families receiving the tax credit and 2 making.

Connecticut State Department of Revenue Services. For 2021 eligible parents or guardians can. Here is some important information to understand about this years Child Tax Credit.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Call the IRS about. The Child Tax Credit helps families with qualifying children get a tax break.

About The 2021 Expanded Child Tax Credit Payment Program

Child Tax Credit What We Do Community Advocates

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

/cloudfront-us-east-1.images.arcpublishing.com/gray/7XVLE5VWLVDV5I36374YHUTMN4.jpg)

Madison Co Accountant Gives Advice On Child Tax Credits

/cloudfront-us-east-1.images.arcpublishing.com/gray/OFLFFXUVBFGBHHRPXF3OCRM7PA.jpg)

File Taxes For 2021 To Receive Your Full Child Tax Credit

New Child Tax Credit Explained When Will Monthly Payments Start 9news Com

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

When Parents Can Expect Their Next Child Tax Credit Payment

Irs Sending Letters About Child Tax Credit

How The 3 000 Child Tax Credit Could Affect Your Tax Bill

Advance Child Tax Credit Payments Begin July 15

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

/cloudfront-us-east-1.images.arcpublishing.com/pmn/XWCBCGFIQJGWLJ77MFWHDRIAOQ.jpg)

Low Income People Who Don T File Tax Returns Will Have A Hard Time Accessing Child Tax Credit Checks

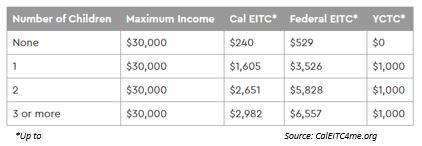

New Young Child Tax Credit Higher Income Limits Among Highlights Of This Year S California Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

Will You Have To Repay The Advanced Child Tax Credit Payments

Receive Up To 250 300 Per Month Per Child In Tax Credit Payments Globe Times

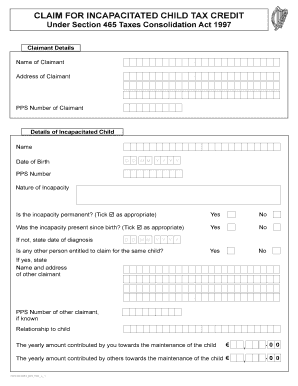

Child Tax Credit Form Fill Online Printable Fillable Blank Pdffiller

Don T Miss Out On The Expanded Child Tax Credit Advocates For Ohio S Future